Buying and Selling Funds from Full Tilt Poker Accounts

The ��High Stakes PL/NL�� forum on TwoPlusTwo hosts a running thread titled "hsnl xfer thread: for active/reputable hsnl community members only" where posters can solicit and search for various online poker transfers. Most transfers are from site to site, such as from PartyPoker to PokerStars, but posters also set up transactions using cash, physical chips, bank wires and other forms of currency.

Before Black Friday, one of the more popular trades was Full Tilt Poker to PokerStars, and visa versa. In fact, Andrew ��BalugaWhale�� Seidman requested $4,000 on Full Tilt for $4,000 on PokerStars on April 11, 2011, just days before the poker world was rocked by the United States Department of Justice. The deal was made by a poster named ��KJM�� later the same day, and Seidman��s funds were frozen less than a week later.

��A large part of my roll was on Full Tilt,�� Seidman told PokerNews. ��Probably half. I was swapping for the FTOPS [Full Tilt Online Poker Series].��

Once Black Friday struck, the marketplace changed because no one knew the true value of money on either Full Tilt, PokerStars or Absolute Poker/Ultimate Bet. Transfers weren��t working either, yet people were openly trying to swap between the sites or were trying to unload their balances for currency on other sites or cash/chips. A week after Black Friday, PokerStars began returning funds to U.S. players, but Full Tilt and AP/UB were still up in the air.

The value of money on AP/UB plummeted, and less than two weeks after Black Friday, players began selling funds at 50 cents on the dollar. For example, if a player had $100 on AP/UB, he was able to sell it for $50 in PokerStars money, cash, or other considerations.

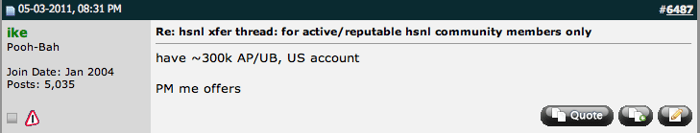

On May 3, 2011, Isaac Haxton posted the following:

The Full Tilt market was initially more stable, but it too began to decline rapidly. By July, the price dropped down to around 70 cents on the dollar. By September, the price ranged from anything as high as 12 cents on the dollar to as low as 1 cent on the dollar. The price then shot back up to 60 to 80 cents on the dollar in early October, when Group Bernard Tapie ��acquired�� Full Tilt.

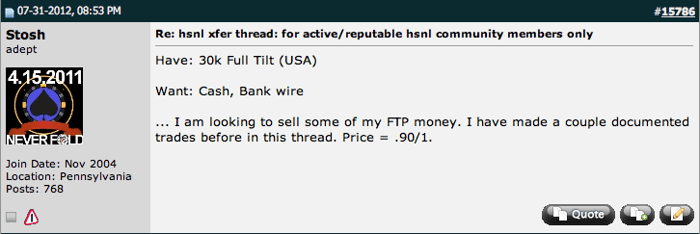

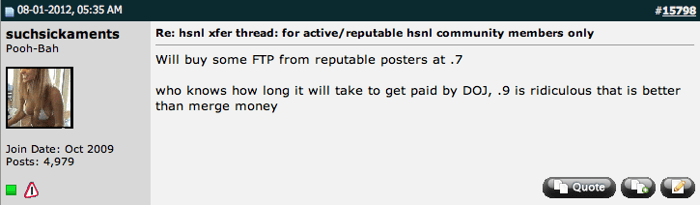

The market continued to fluctuate over the next nine months, and on Tuesday, when PokerStars actually acquired Full Tilt��s assets, the posters were still uncertain of the true value of Full Tilt money. Some players were asking for as much as 90 cents on the dollar, while others thought that was way too high:

On Tuesday, I asked my Twitter followers if any of them had bought Full Tilt funds for less than face value, and I received very few responses. Aaron Steury informed me that he bought an entire account on Tuesday for 85 cents on the dollar, but didn��t disclose the amount of the account. I contacted Octo-Niner Greg Merson, who allegedly sold his Full Tilt account after Black Friday, and he said the following:

��I��m super happy for everyone in the community. The poker world has been through so much the last 15 months and deserves this type of news.��

Again, nothing concrete about the sale of his account.

Later that day, Dan Fleyshman joined Kristy Arnett and myself on a mega edition of the PokerNews Podcast, and he said that he recommended players to sell their accounts for as low as 50 cents on the dollar during the Tapie fiasco. Fleyshman also told us that ��household name�� players bought funds from other ��household name�� players, and there were some ��seven-figure deals that went down at 70 cents on the dollar,�� but he gave no names.

According to TwoPlusTwo poster Daniel ��d2themfi�� Isaacson, one of these seven-figure deals may have gone down in April of 2011. Isaacson was at dinner with Daniel ��Jungleman�� Cates, and Cates told him that he sold his Full Tilt account balance for, ��I believe 85 percent but I can��t remember.�� Cates�� friends asked him if he sold it to Tom ��Durrrr�� Dwan, and he responded, ��Something like that.��

Neither Dwan nor Cates have confirmed this. Cates�� Full Tilt balance is estimated to be worth $6 million.

The most interesting response I received on Tuesday was from Mike Sowers, but it didn��t name any names. It was a warning:

@RichTRyan be careful...u are going to get lots of these people who have a whole new ftp sweat on their hands. #bouttofindoutwhoucantrust

— mike sowers (@sowerss)

Sowers�� warning is not unwarranted either �� we��ve seen plenty of deals go wrong in the poker world. Seidman informed me that he has screenshots and saved messages from transactions he made, and some posters discussed contracts in the ��hsnl xfer thread,�� but with so much swapping and re-swapping going on, there could be a lot of information and money lost in translation.

It will be less of a hassle for people who swapped with ��rest of world�� players, because their funds will be untouched by the DOJ, whereas U.S. players don��t even know how to apply for their money yet. Additionally, there is wide speculation within the poker community that U.S. players will have to pay taxes on their account balances. This is obviously detrimental to players who sold funds, because unless they discussed taxes as part of the deal, they will lose a substantial amount of money.

It will only be a matter of time until the ��(Insert name) is a scammer�� threads start popping up on News, Views and Gossip.

For now, all we can do is wait. Seidman is confident that everything will be ��relatively doable,�� but Sowers�� warning keeps echoing in the back of my head. Millions of dollars have been transferred during the last 15 months, and the only thing that buyers have received is promises, documents, emails, and screen shots. The younger generation of players have always referred to themselves as ��more trustworthy�� than the old-school ��live pros.�� Well, this is their first big test.

Let��s hope that they pass with flying colors.

Follow PokerNews on Twitter for up-to-the-minute news.